Revealed: Our favourite hack to get the best deal on a personal loan. There are thousands of options online, but our favourite website for comparing personal loans was RateSetter.

Let me explain why: 4.5/5 stars on Trustpilot from real, genuine customers. Helping borrowers and investors achieve more (for less) with peer-to-peer lending. Australia’s most-loved personal loan.

See For Yourself

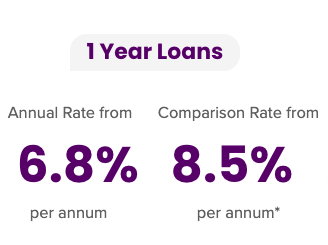

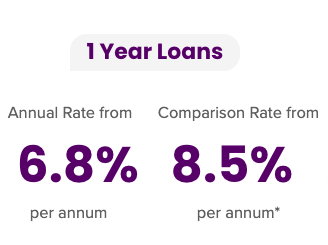

1 Year Loans

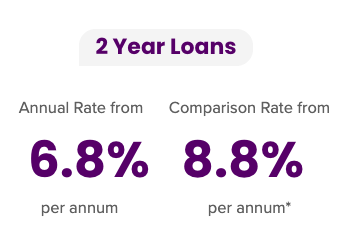

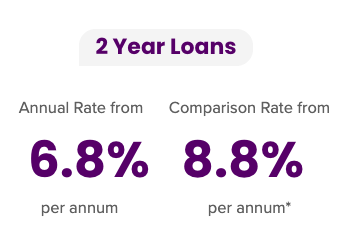

2 Year Loans

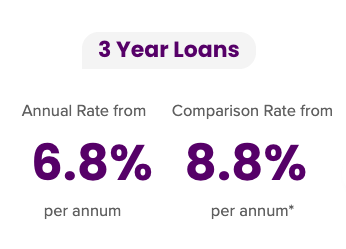

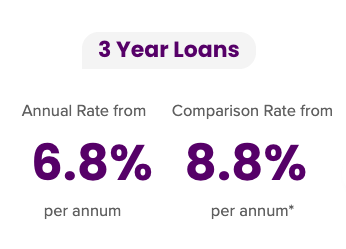

3 Year Loans

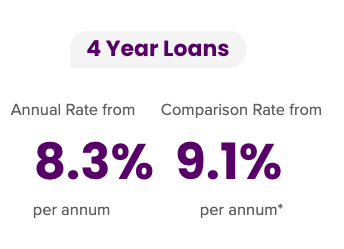

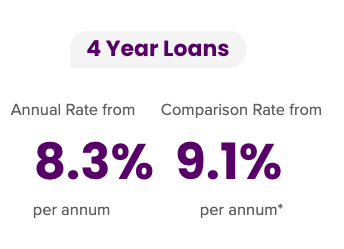

4 Year Loans

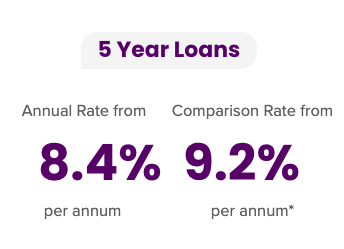

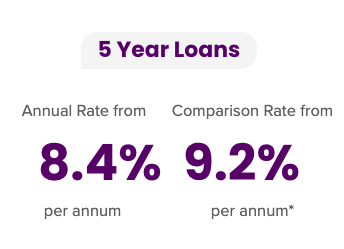

5 Year Loans

1 Year Loans

See For Yourself

1 Year Loans

2 Year Loans

3 Year Loans

4 Year Loans

5 Year Loans

1 Year Loans

2 Year Loans

2 Year Loans

3 Year Loans

3 Year Loans

4 Year Loans

4 Year Loans

5 Year Loans

5 Year Loans

Get Your Rate

Get your rate

Apply in minutes

Enjoy your funds

Get your rate

Discover your personalised interest rate in just 1 minute. It’s fast, simple and won’t have any impact on your credit score.

Apply in minutes

You can apply for a loan online in under 10 minutes. Make sure you have your driver’s license and bank details handy.

Enjoy your funds

They will review your application. Once your loan is approved and funded your funds will be with you the next business day.

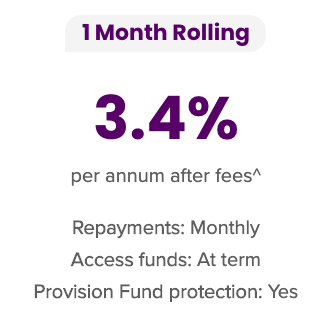

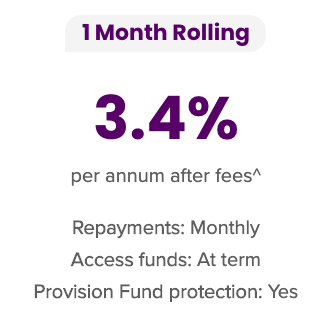

1 Month Rolling

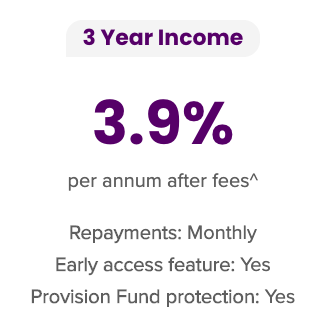

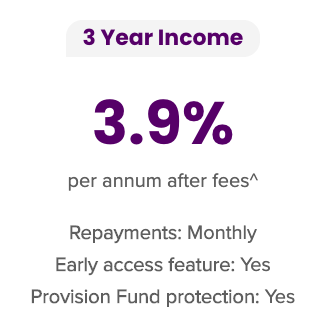

3 Year Income

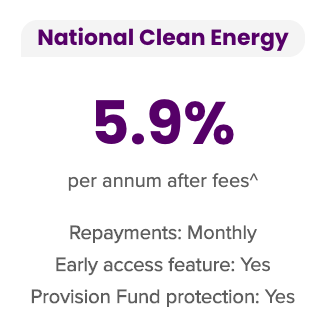

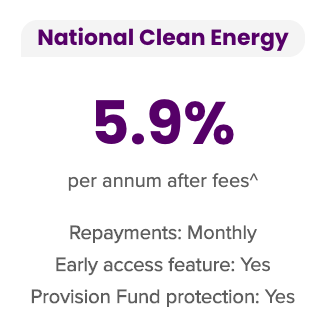

National Clean Energy

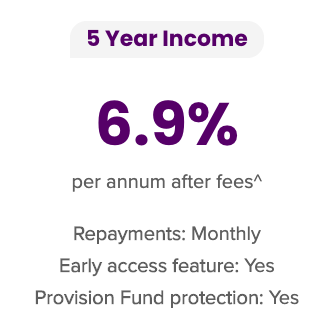

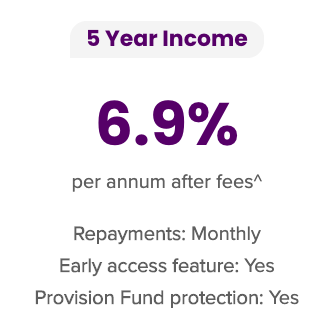

5 Year Income

1 Month Rolling

Get Your Rate

Get your rate

Apply in minutes

Enjoy your funds

Get your rate

Discover your personalised interest rate in just 1 minute. It’s fast, simple and won’t have any impact on your credit score.

Apply in minutes

You can apply for a loan online in under 10 minutes. Make sure you have your driver’s license and bank details handy.

Enjoy your funds

They will review your application. Once your loan is approved and funded your funds will be with you the next business day.

1 Month Rolling

3 Year Income

National Clean Energy

5 Year Income

1 Month Rolling

3 Year Income

3 Year Income

National Clean Energy

National Clean Energy

5 Year Income

5 Year Income

Start Investing

Start Investing

I applied on a Friday and by Wednesday I had the money in my account. The repayments are very reasonable.

SantiagoNSW

Ratesetter provided an excellent quote at less than half of what I was paying with another lender which I gladly accepted.

ScottQLD

So easy! Everything was done online and any questions I had were answered in an extremely timely manner.

KatrinaWA

Previous

Next

RateSetter bring borrowers and investors together to help them achieve more with their money. It’s as simple as that. They have an award winning, low rate personal loans from 6.79% p.a. (comparison rate 8.46% p.a.)* with no ongoing fees.

Apply Now

Featured,Fintech,Legaltech

/

February 24, 2020

/

Lynne Becera

I applied on a Friday and by Wednesday I had the money in my account. The repayments are very reasonable.

SantiagoNSW

Ratesetter provided an excellent quote at less than half of what I was paying with another lender which I gladly accepted.

ScottQLD

So easy! Everything was done online and any questions I had were answered in an extremely timely manner.

KatrinaWA

Previous

Next

RateSetter bring borrowers and investors together to help them achieve more with their money. It’s as simple as that. They have an award winning, low rate personal loans from 6.79% p.a. (comparison rate 8.46% p.a.)* with no ongoing fees.

Apply Now

Featured,Fintech,Legaltech

/

February 24, 2020

/

Lynne Becera

See For Yourself

1 Year Loans

2 Year Loans

3 Year Loans

4 Year Loans

5 Year Loans

1 Year Loans

See For Yourself

1 Year Loans

2 Year Loans

3 Year Loans

4 Year Loans

5 Year Loans

1 Year Loans

2 Year Loans

2 Year Loans

3 Year Loans

3 Year Loans

4 Year Loans

4 Year Loans

5 Year Loans

5 Year Loans

Get Your Rate

Get your rate

Apply in minutes

Enjoy your funds

Get your rate

Discover your personalised interest rate in just 1 minute. It’s fast, simple and won’t have any impact on your credit score.

Apply in minutes

You can apply for a loan online in under 10 minutes. Make sure you have your driver’s license and bank details handy.

Enjoy your funds

They will review your application. Once your loan is approved and funded your funds will be with you the next business day.

1 Month Rolling

3 Year Income

National Clean Energy

5 Year Income

1 Month Rolling

Get Your Rate

Get your rate

Apply in minutes

Enjoy your funds

Get your rate

Discover your personalised interest rate in just 1 minute. It’s fast, simple and won’t have any impact on your credit score.

Apply in minutes

You can apply for a loan online in under 10 minutes. Make sure you have your driver’s license and bank details handy.

Enjoy your funds

They will review your application. Once your loan is approved and funded your funds will be with you the next business day.

1 Month Rolling

3 Year Income

National Clean Energy

5 Year Income

1 Month Rolling

3 Year Income

3 Year Income

National Clean Energy

National Clean Energy

5 Year Income

5 Year Income

Start Investing

Start Investing

How lending works?

How rates are set Investors select the market they wish to invest in, the amount they wish to invest, and set the rate at which they wish to lend at. This is known as creating a ‘lending order’. Lending orders are then matched to borrower loans, with the lowest rate lending orders in each market taking priority. As such, the rates in each lending market are set by investors and borrowers, according to the supply and demand of funds at different interest rates. How investors are matched with borrowers Their technology automatically matches investor lending orders to the loans of borrowers that have met their credit requirements. Investors do not have to select specific loans to fund, and their lending order may be matched to a single loan or multiple loans. The Provision Fund can help protect your investment in the event of a borrower missed payment or default. How investors earn returns Investors receive payments that borrowers make on loans they have funded. Borrower repayments can be automatically reinvested back into the relevant lending market, helping investors earn returns on both their initial principal and the interest earned. Alternatively, investors can choose to withdraw either the whole amount or just the interest portion of borrower repayments to their nominated bank account. If a borrower misses a repayment, the Provision Fund can compensate investors to help protect against any losses.Peer-to-peer investing that’s as simple as

Register Transfer in funds Invest in loans Register Complete your registration online in minutes. You can register individually or as a company or SMSF trustee. Transfer in funds Transfer funds through BPAY or bank transfer. Funds typically arrive the next business day. Invest in loans Choose the lending market you want to invest in, set your rate and get matched with creditworthy borrowers. Start Investing I applied on a Friday and by Wednesday I had the money in my account. The repayments are very reasonable.

SantiagoNSW

Ratesetter provided an excellent quote at less than half of what I was paying with another lender which I gladly accepted.

ScottQLD

So easy! Everything was done online and any questions I had were answered in an extremely timely manner.

KatrinaWA

Previous

Next

RateSetter bring borrowers and investors together to help them achieve more with their money. It’s as simple as that. They have an award winning, low rate personal loans from 6.79% p.a. (comparison rate 8.46% p.a.)* with no ongoing fees.

Apply Now

Featured,Fintech,Legaltech

/

February 24, 2020

/

Lynne Becera

I applied on a Friday and by Wednesday I had the money in my account. The repayments are very reasonable.

SantiagoNSW

Ratesetter provided an excellent quote at less than half of what I was paying with another lender which I gladly accepted.

ScottQLD

So easy! Everything was done online and any questions I had were answered in an extremely timely manner.

KatrinaWA

Previous

Next

RateSetter bring borrowers and investors together to help them achieve more with their money. It’s as simple as that. They have an award winning, low rate personal loans from 6.79% p.a. (comparison rate 8.46% p.a.)* with no ongoing fees.

Apply Now

Featured,Fintech,Legaltech

/

February 24, 2020

/

Lynne Becera