Business Line Of Credit

Prospa is Australia’s #1 online lender to small businesses. Unlike traditional lenders, Prospa understands small business owners need faster finance solutions – so you can make decisions quickly and seize opportunities with total confidence.

Prospa is a multi-award winning, high-growth company. Prospa was awarded the Telstra Business Award for Best Medium Business NSW in 2017, and in 2018 topped the Financial Times list of high-growth companies in Asia-Pacific.

In 2018 Prospa achieved a clean sweep of the MFAA Excellence Awards for Fintech Lender of the Year, winning in all states and nationally. Prospa is an AON Hewitt Employer of Choice two years in a row and ranked 6th in LinkedIn’s Top Startup Places to Work, Australia 2018.

Check Out Prospa

Check Out Prospa

Their

Prospa | Top Pick

Moula

Business Fuel

OnDeck

Capify

Limba

Lumi

Prospa | Top Pick

Prospa offers business loans of between

$5,000 and $300,000 with no security required to access up to $100,000. Application takes just 10 minutes, you can get same day approval, and

funding is possible in 24 hours. Using a smart proprietary technology platform, they focus on the health of a business to determine creditworthiness.

Moula

Moula

Moula provides loans to small and medium businesses through a unique platform that efficiently analyses data about a business loan applicant and determines the appropriate level of funding to provide.

Moula is not a P2P lender, as it has its own Balance Sheet and does not rely on a platform to fund loans.

Business Fuel

They provide quick capital from $10,000 to $200,000 to help small businesses across a range of industries.

Their lending team has a wealth of experience in business finance and are ready to help you find the right financial solution for your business. Tailoring finance to their customers’ needs and transferring funds in 24 hours or less is their speciality.

OnDeck

OnDeck launched in 2007 to solve a major issue facing small businesses: efficient access to capital.

Their passion for Main Street and the cutting-edge technology they use to evaluate businesses based on their actual performance, not solely business owners’ personal credit scores, make it possible for them to responsibly expand access to credit. This allows businesses to spend their time where it provides the most benefit—on their customers and on growing, not looking for a small business loan.

They understand that financing a small business can be a challenge that requires more time than most small business owners have in a day. Business operations, accounts receivable, accounting, and marketing are all an important part of running a small business—and financing shouldn’t slow down your focus on these issues; it should instead help a business grow.

OnDeck offers financing options like short and longer-term loans and lines of credit, in order to grow your business.

Capify

Capify was born out of the desire to offer small businesses an alternative and accessible lending option. Proudly they were the first to do so in Australia. With 10+ years of local experience providing small business loans working capital globally, Capify is Australia’s most experienced alternative lender to small business.

With a focus on customer service and simplicity; our vision is to support Australian businesses with tailored financial solutions and solve small business finance. With our philosophy, they work together to create the most flexible and accessible commercial business loans for our clients. This allows them to streamline their internal processes passing on time and cost savings to you.

Limba

Limba is a new name for an established business – City Finance Business Lending. As one of Australia’s most experienced business lenders, City Finance has a proud 20-year business history behind them.

If you’re looking to evolve or expand your business, you can partner with Limba with complete confidence. They’ve been serving the needs of small businesses since 1998 – and the only thing that’s changed in that time is their name.

Lumi

At Lumi, you’re not just a loan. You’re a small business owner with big dreams and we’re here to support you.

Their Vision

For too long, business owners have found it difficult to attain the funding they need to help their business grow. Forget lengthy application processes and sneaky, hidden fees. Lumi is shaking up small business lending to provide you with fast access to finance that’s accurate, fair, and honest. They’re all about total transparency and are setting high standards for the fintech industry worldwide.

Access to funds when you

it

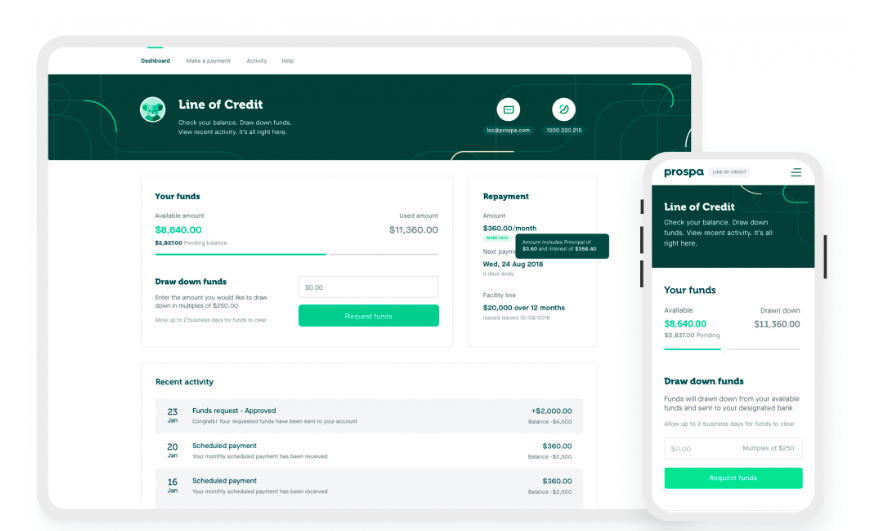

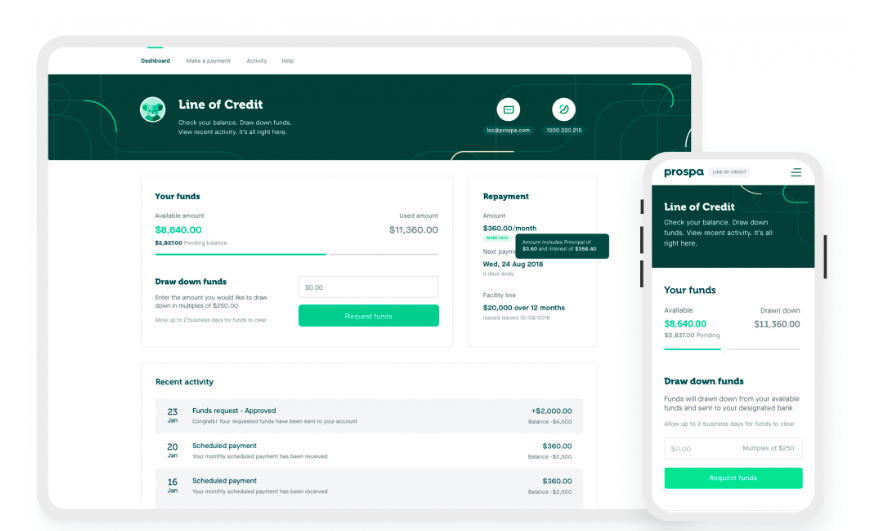

A Prospa Line of Credit is a cash flow safety net up to $100K. Dip in when you need to and only pay interest on the funds you use while you use them. Get a quick decision and funding is possible in 24 hours.

It’s today’s way to borrow.

Flexible. To put you in control

- Revolving Line of Credit of between $2,000 and $100,000

- Use and reuse as many times as you need throughout the renewable 12-month term

- Only pay interest on what you use, while you use it

- Make additional principal repayments at any time

Simple. To save you time and effort

- Apply in 10 minutes with minimal paperwork

- Fast decision with funding possible in 24 hours

- No asset security required upfront to access the funds

- Access funds wherever and whenever with the Prospa Mobile App and Customer Portal

Real. To give you the information and support you need

- A team of Business Lending Specialists available however suits you – phone, email chat

- Business resource hub to help you stay informed

- Competitive rates tailored to the health of your business

- Transparent fees: $195 charged on first draw down; $25 monthly subscription after first draw down

How It

Check if you qualify

Check if you qualify

If your monthly turnover is more than $6,000 and you have over 6 months trading history, you’re ready to go.

Apply in 10 minutes

You need an active ABN, business bank account details & driver licence details (plus business financials for loans over $150,000).

Get on with business

With funding possible in 24 hours and 24/7 access via the Prospa Mobile App and Customer Portal.

Apply Now

What could your business do with a

- Purchase equipment or tools

- A renovation or fit out

- Upgrade equipment or machinery

- Marketing campaigns or promotions

- Build a website

- Buy office or café furniture

- Pay tax or BAS lump sums

Get ongoing access to funds with a

A Prospa Line of Credit is a safety net designed to give you the confidence to focus on what you love about your business – without worrying about day-to-day finances.

Business Line of Credit

With their Line of Credit small businesses like yours can be approved for up to $100,000. You can draw down when you need to (up to your approved limit) and only pay interest on what you use, for as long as you use it. It’s a revolving line of credit available over a 12 month term, providing funds when you need them.

Talk to them

Join the thousands of small businesses that have received business funds from Prospa. Simply submit your application online or call them on

1300 882 867. One of their friendly lending specialists will work with you to customise a proposal and answer your questions.

Business loans made easy

At Prospa, they specialise in Australian

business lending with a fast and easy business loan application process, offering more flexible small business financing options that works with you to grow your business.

Fast decisions

Once your application is approved, funding is possible in 24 hours. There is no cost to apply, no obligation to proceed and no hidden fees.

They care about small business

Whether it’s a business overdraft,

equipment finance or cash flow support, they are passionate about helping small business owners access the money they need to maintain the momentum. Their founders were small business owners themselves and know the challenges of running a small business.

They know their stuff

Prospa is trusted by Australian small businesses with over $1.35 billion lent to more than 24,000 Australian business owners so far. They are Australia’s #1 online lender to small businesses and #1 Best Non-Bank Finance company on Trustpilot.

They won Fintech lender of the Year at the MFAA Excellence Awards and topped the FT1000 High Growth Company list for the Asia Pacific region in 2018. Prospa is a proud signatory of AFIA’s Online Small Business Lenders Code of Lending Practice.

Quality partners

They have a network of over 10,000+ distribution partners who help them provide online business finance, including integration partners like Xero and Reckon; as well as brokers, accountants and franchisors around Australia.

Take the next step

There is no cost to apply for their business loans or line of credit, so why not find out whether you qualify now? Call

1300 882 867 or get started on your application today.

Apply Now

See All Awards

See All Awards

Common

How do I apply?

The application process is easy and fast. Simply complete the online form in as little as 10 minutes. If you are applying for $150,000 or less, you need:

- Your driver licence number

- Your ABN

- Your BSB and account number

For loans over $150,000, you’ll also need some basic financial statements, like a P&L and cash flow.

How fast will I get a decision?

Typically, they can provide a response within an hour when applying during standard business hours and allow us to use the advanced bank verification system link which enables us to instantly verify your bank information online. If you choose to upload copies of your bank statements, we can provide a decision in as little as one business day.

How fast will I get the money?

If you apply before 4pm on a business day and your application is approved, it is possible to have money in your account as early as the next business day.

How much can I borrow?

The total amount you can borrow will depend on the specific circumstances of your business. They consider a variety of factors to determine the health of your business and based on this information, Prospa may be able to provide you a loan amount of up to $300,000.

What can the Prospa Small Business Loan be used for?

A Prospa Small Business Loan can be used for almost any business purpose – including for growth, to take advantage of an opportunity or to support cash flow. For example, it could be used for business renovations, marketing, to purchase inventory or new equipment, as general working capital and much more. Funds from Prospa’s Small Business Loan cannot be used for personal purposes.

How is the Prospa Small Business Loan different from a traditional business loan?

You can apply for the Prospa Small Business Loan in as little as 10 minutes online or over the phone. Depending on the time of day you apply, approvals can be achieved “same-day” with funds in your account within 24 hours. The Prospa Small Business Loan details the total amount payable upfront including any interest, fees or charges. This is then broken down into either a daily or weekly repayment figure.

Tell me about the Prospa Small Business Loan?

Prospa offers Small Business Loans of $5,000 to $300,000 with terms between 3 and 24 months and cash flow friendly repayments that are either daily or weekly.

What are the fees and repayments?

There are no hidden fees for their Small Business loans, and you’ll know exactly how much and when you need to pay from day one. There’s no compounding interest, no penalties for early repayment and no additional fees (as long as you make your repayments on time).

Our

Prospa does business loans without painful paperwork or waiting in queues, they are the leading online provider of small business loans in Australia. Unlike traditional lenders, Prospa understands small business owners need faster finance solutions – so you can make decisions quickly and seize opportunities with total confidence.

Fintech

/

January 21, 2020

/

Lynne Becera

Check Out Prospa

Check Out Prospa

Prospa offers business loans of between $5,000 and $300,000 with no security required to access up to $100,000. Application takes just 10 minutes, you can get same day approval, and funding is possible in 24 hours. Using a smart proprietary technology platform, they focus on the health of a business to determine creditworthiness.

Moula

Prospa offers business loans of between $5,000 and $300,000 with no security required to access up to $100,000. Application takes just 10 minutes, you can get same day approval, and funding is possible in 24 hours. Using a smart proprietary technology platform, they focus on the health of a business to determine creditworthiness.

Moula

Moula provides loans to small and medium businesses through a unique platform that efficiently analyses data about a business loan applicant and determines the appropriate level of funding to provide. Moula is not a P2P lender, as it has its own Balance Sheet and does not rely on a platform to fund loans.

Business Fuel

Moula provides loans to small and medium businesses through a unique platform that efficiently analyses data about a business loan applicant and determines the appropriate level of funding to provide. Moula is not a P2P lender, as it has its own Balance Sheet and does not rely on a platform to fund loans.

Business Fuel

They provide quick capital from $10,000 to $200,000 to help small businesses across a range of industries.

Their lending team has a wealth of experience in business finance and are ready to help you find the right financial solution for your business. Tailoring finance to their customers’ needs and transferring funds in 24 hours or less is their speciality.

OnDeck

They provide quick capital from $10,000 to $200,000 to help small businesses across a range of industries.

Their lending team has a wealth of experience in business finance and are ready to help you find the right financial solution for your business. Tailoring finance to their customers’ needs and transferring funds in 24 hours or less is their speciality.

OnDeck

OnDeck launched in 2007 to solve a major issue facing small businesses: efficient access to capital. Their passion for Main Street and the cutting-edge technology they use to evaluate businesses based on their actual performance, not solely business owners’ personal credit scores, make it possible for them to responsibly expand access to credit. This allows businesses to spend their time where it provides the most benefit—on their customers and on growing, not looking for a small business loan.

They understand that financing a small business can be a challenge that requires more time than most small business owners have in a day. Business operations, accounts receivable, accounting, and marketing are all an important part of running a small business—and financing shouldn’t slow down your focus on these issues; it should instead help a business grow. OnDeck offers financing options like short and longer-term loans and lines of credit, in order to grow your business.

Capify

OnDeck launched in 2007 to solve a major issue facing small businesses: efficient access to capital. Their passion for Main Street and the cutting-edge technology they use to evaluate businesses based on their actual performance, not solely business owners’ personal credit scores, make it possible for them to responsibly expand access to credit. This allows businesses to spend their time where it provides the most benefit—on their customers and on growing, not looking for a small business loan.

They understand that financing a small business can be a challenge that requires more time than most small business owners have in a day. Business operations, accounts receivable, accounting, and marketing are all an important part of running a small business—and financing shouldn’t slow down your focus on these issues; it should instead help a business grow. OnDeck offers financing options like short and longer-term loans and lines of credit, in order to grow your business.

Capify

Capify was born out of the desire to offer small businesses an alternative and accessible lending option. Proudly they were the first to do so in Australia. With 10+ years of local experience providing small business loans working capital globally, Capify is Australia’s most experienced alternative lender to small business.

With a focus on customer service and simplicity; our vision is to support Australian businesses with tailored financial solutions and solve small business finance. With our philosophy, they work together to create the most flexible and accessible commercial business loans for our clients. This allows them to streamline their internal processes passing on time and cost savings to you.

Limba

Capify was born out of the desire to offer small businesses an alternative and accessible lending option. Proudly they were the first to do so in Australia. With 10+ years of local experience providing small business loans working capital globally, Capify is Australia’s most experienced alternative lender to small business.

With a focus on customer service and simplicity; our vision is to support Australian businesses with tailored financial solutions and solve small business finance. With our philosophy, they work together to create the most flexible and accessible commercial business loans for our clients. This allows them to streamline their internal processes passing on time and cost savings to you.

Limba

Limba is a new name for an established business – City Finance Business Lending. As one of Australia’s most experienced business lenders, City Finance has a proud 20-year business history behind them.

If you’re looking to evolve or expand your business, you can partner with Limba with complete confidence. They’ve been serving the needs of small businesses since 1998 – and the only thing that’s changed in that time is their name.

Lumi

Limba is a new name for an established business – City Finance Business Lending. As one of Australia’s most experienced business lenders, City Finance has a proud 20-year business history behind them.

If you’re looking to evolve or expand your business, you can partner with Limba with complete confidence. They’ve been serving the needs of small businesses since 1998 – and the only thing that’s changed in that time is their name.

Lumi

At Lumi, you’re not just a loan. You’re a small business owner with big dreams and we’re here to support you.

Their Vision

For too long, business owners have found it difficult to attain the funding they need to help their business grow. Forget lengthy application processes and sneaky, hidden fees. Lumi is shaking up small business lending to provide you with fast access to finance that’s accurate, fair, and honest. They’re all about total transparency and are setting high standards for the fintech industry worldwide.

At Lumi, you’re not just a loan. You’re a small business owner with big dreams and we’re here to support you.

Their Vision

For too long, business owners have found it difficult to attain the funding they need to help their business grow. Forget lengthy application processes and sneaky, hidden fees. Lumi is shaking up small business lending to provide you with fast access to finance that’s accurate, fair, and honest. They’re all about total transparency and are setting high standards for the fintech industry worldwide.

Check if you qualify

If your monthly turnover is more than $6,000 and you have over 6 months trading history, you’re ready to go.

Apply in 10 minutes

You need an active ABN, business bank account details & driver licence details (plus business financials for loans over $150,000).

Get on with business

With funding possible in 24 hours and 24/7 access via the Prospa Mobile App and Customer Portal.

Apply Now

Check if you qualify

If your monthly turnover is more than $6,000 and you have over 6 months trading history, you’re ready to go.

Apply in 10 minutes

You need an active ABN, business bank account details & driver licence details (plus business financials for loans over $150,000).

Get on with business

With funding possible in 24 hours and 24/7 access via the Prospa Mobile App and Customer Portal.

Apply Now

See All Awards

See All Awards