Revealed:

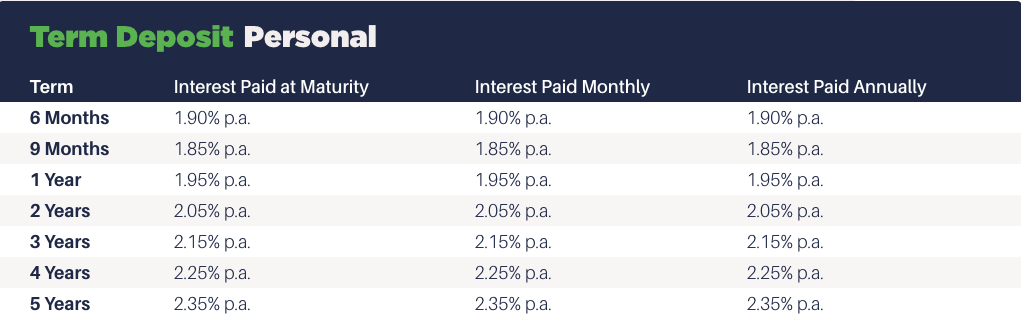

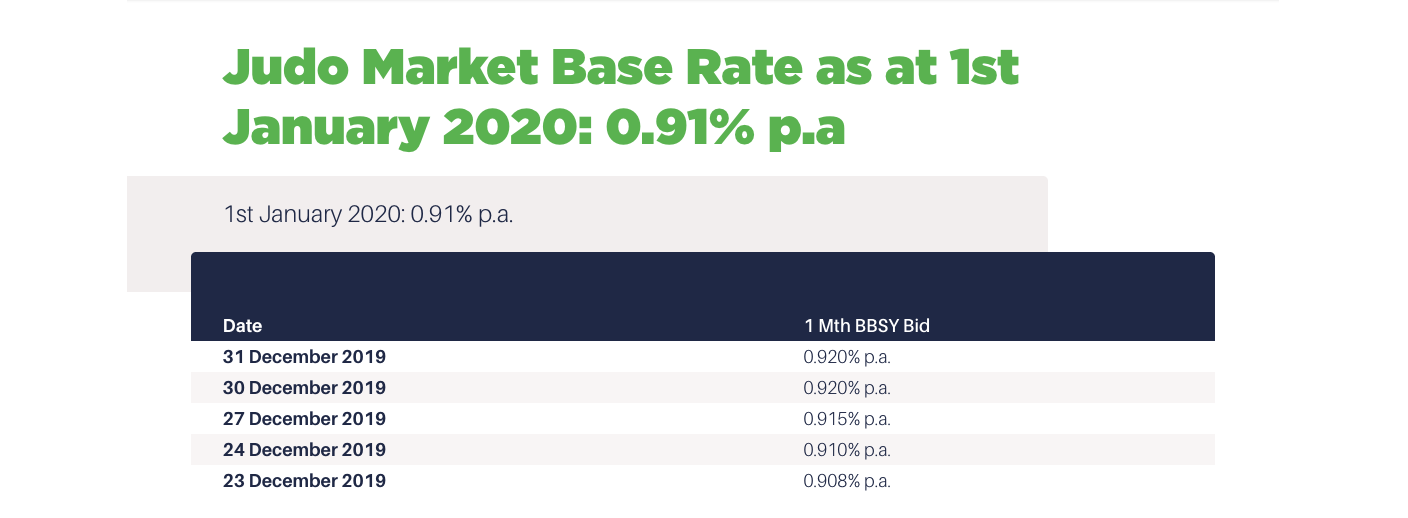

Judo Bank is a new SME challenger bank built specially to make it easier for Aussie businesses to get the funding they need. Their Term Deposit rates, for example, are sitting at 2.4% (which is massive in the current climate!). They also specialise in lending to SMEs and aim to fill the void left by the big 4. Check Out Judo Bank

Check Out Judo Bank

Who are their

Judo Bank Xinja Volt Bank 86 400 Pelikin Revolut Up Judo Bank They provide business lending solutions starting from $250,000 for small to medium-sized businesses. Their team of experienced business bankers are currently located in Melbourne, Sydney and Brisbane, with many more locations to come.

Xinja

They provide business lending solutions starting from $250,000 for small to medium-sized businesses. Their team of experienced business bankers are currently located in Melbourne, Sydney and Brisbane, with many more locations to come.

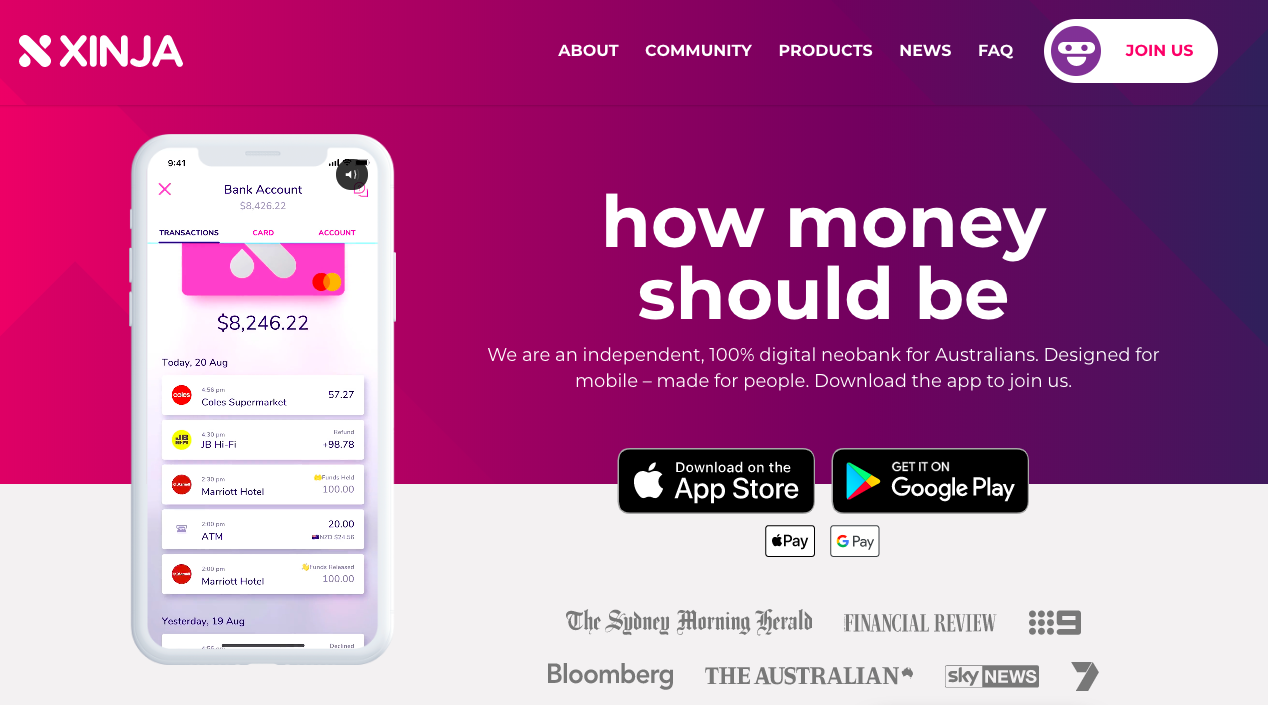

Xinja

Xinja will revolutionise your banking experience, not just making it quick and easy but fun to track your spending & save for what you want. More importantly, it will help you (effortlessly) get ahead. So more than a mobile banking app (because it really helps you make the most out of your money) and more than a money management app (because it’s immediate – virtual banking and money management combined). And more than both, because it’s intuitive, easy, instant and fun to use.

Volt Bank

Xinja will revolutionise your banking experience, not just making it quick and easy but fun to track your spending & save for what you want. More importantly, it will help you (effortlessly) get ahead. So more than a mobile banking app (because it really helps you make the most out of your money) and more than a money management app (because it’s immediate – virtual banking and money management combined). And more than both, because it’s intuitive, easy, instant and fun to use.

Volt Bank

Volt began with the aim of doing things the right way. To try and reverse or replace some of the ways of doing things that had become normal.

Normal to hide fees. Normal to keep loyal customers on worse deals than new ones. Normal to use confusing language. Normal to not fix mistakes. Normal to just make you feel like a number – except, of course, when it’s advertising.

86 400

Volt began with the aim of doing things the right way. To try and reverse or replace some of the ways of doing things that had become normal.

Normal to hide fees. Normal to keep loyal customers on worse deals than new ones. Normal to use confusing language. Normal to not fix mistakes. Normal to just make you feel like a number – except, of course, when it’s advertising.

86 400

One that’s fit for purpose in today’s mobile world.

One that tells you what’s actually going on with your money, so you feel in control every second of every day. All eighty-six four hundred of them.

A bank with great rates and no monthly fees, which uses smart technology to show the most relevant information about your spending, saving and bills, so you can plan forward, as well as look backward.

Pelikin

One that’s fit for purpose in today’s mobile world.

One that tells you what’s actually going on with your money, so you feel in control every second of every day. All eighty-six four hundred of them.

A bank with great rates and no monthly fees, which uses smart technology to show the most relevant information about your spending, saving and bills, so you can plan forward, as well as look backward.

Pelikin

Pelikin is a fully app-based Australian fintech that’s aiming to change the way Aussie travellers (what they call the Pelikin Squad) manage their money while overseas.

Based in Melbourne, Pelikin have already released a travel money app and prepaid card that can be used to pay in over 200 countries and to easily swap between multiple currencies at the tap of a screen, as well as travel insurance. The app also has some awesome features that set them apart from their competitors, like digital wallets that can hold up to five currencies at once and an internal split bill function.

Pelikin aren’t a bank or neobank, they’re are a multi-currency digital account. But they’re backed by UK company Tuxedo Money Solutions to provide their app and card, as well as locally in Australia with Heritage Bank who issue their Visa debit card.

At the moment Pelikin are focused on cracking the travel money market by offering a stand-out and unique product in their travel money card and app, but that’s not to say that we won’t see more products from this company in the future.

Revolut Revolut launched in July 2015

They’re here for those who refuse to settle. Who never stop moving forwards. Who continue to search for new ideas and better experiences in everything they do.

Because today’s hyper-connected world deserves a financial partner just as progressive.One that adapts to your needs, gives you control and constantly pushes you into new exciting spaces.

Global spending and transfers without rubbish exchange rates. Whether you’re running a business or running out for bread, Revolut is building a global bank to suit your lifestyle.

Up

Revolut launched in July 2015

They’re here for those who refuse to settle. Who never stop moving forwards. Who continue to search for new ideas and better experiences in everything they do.

Because today’s hyper-connected world deserves a financial partner just as progressive.One that adapts to your needs, gives you control and constantly pushes you into new exciting spaces.

Global spending and transfers without rubbish exchange rates. Whether you’re running a business or running out for bread, Revolut is building a global bank to suit your lifestyle.

Up

Up headquarters is the Citadel, a heritage listed building in South Melbourne circa 1911. It’s where you’ll find us most days creating, thinking, designing, and building.

Up is for everyone. They want their app to work well for you regardless of age, background, education, race, gender, or abilities. Listening and responding to your feedback is baked into our process. You help make Up Up. Talk to Us in the app!

Check Out Judo Bank

“Judo was commercial in their approach, listened to my unique circumstance, and tailored a solution that exceeded my expectations.”

Cole McInnesDealer Principal John Deere

“from that original cup of coffee, we had the financing in place within a month”

Robert BoydCEO Winner Bars

“The Judo team knew exactly what I was looking to achieve.”

Cole McInnesDealer Principal John Deere – GSW Ground Care

“Our finance broker introduced us to Judo Capital. Right away we just felt that the relationship was perfect.”

Susan Mitchell CFO Bastion Collective

“So we spoke to a number of other banks about the opportunity. Well, the banks had difficulty understanding the transaction.”

Duncan RussellManning Director International Mowers

Previous

Next

BUSINESS LOAN

Need funding that’s flexible and repayable over time? Their Judo Bank business loan provides options to support growth or investment in your business.

Features

Up headquarters is the Citadel, a heritage listed building in South Melbourne circa 1911. It’s where you’ll find us most days creating, thinking, designing, and building.

Up is for everyone. They want their app to work well for you regardless of age, background, education, race, gender, or abilities. Listening and responding to your feedback is baked into our process. You help make Up Up. Talk to Us in the app!

Check Out Judo Bank

“Judo was commercial in their approach, listened to my unique circumstance, and tailored a solution that exceeded my expectations.”

Cole McInnesDealer Principal John Deere

“from that original cup of coffee, we had the financing in place within a month”

Robert BoydCEO Winner Bars

“The Judo team knew exactly what I was looking to achieve.”

Cole McInnesDealer Principal John Deere – GSW Ground Care

“Our finance broker introduced us to Judo Capital. Right away we just felt that the relationship was perfect.”

Susan Mitchell CFO Bastion Collective

“So we spoke to a number of other banks about the opportunity. Well, the banks had difficulty understanding the transaction.”

Duncan RussellManning Director International Mowers

Previous

Next

BUSINESS LOAN

Need funding that’s flexible and repayable over time? Their Judo Bank business loan provides options to support growth or investment in your business.

Features

- Choice of Variable or Fixed interest rate.

- Fixed Rate period available for added certainty.

- Flexible repayment options.

- Principal and interest, or interest-only repayments.

- Draw up to the approved limit with no scheduled repayments.

- Variable interest rate.

- Assisting to meet working capital needs.

- Allows drawings and repayments to match your cash flow.

- Fixed interest and repayments with an optional balloon.

- Flexible repayment options.

- Tailor repayment frequency to match your cash flow.

- Help you preserve your working capital.

- Interest and asset depreciation may be tax deductible.

- Fixed interest and repayments for added certainty.

- Judo Bank owns the asset and you lease it with the option to buy at the end of the term.

- Flexible repayment options.

- Tailor repayment frequency to match your cash flow.

- No capital outlay.

- Rentals may be tax-deductible.

- Choice of Variable or Fixed interest rate.

- Flexible repayment options.

- Tailor repayments with a choice of either principal and interest, or interest-only.

Business Term Deposits

Savings made easier, better, just for you.

SMSF Term Deposits

A worry-free way to invest

$

0

bn

Term Deposits Funded

$

0

Term Deposit Customers

Apply Now

Challenger

Relationship Banking

Built to say yes

Challenger

Determined to help SMEs get a fairer go when it comes to banking

Relationship Banking

Banking as it used to be…banking as it should be.

Built to say yes

Purpose-built to make it easier for SMEs to get the funding they need when they need it.

$

0

m

Largest capital raise in Australian history

$

0

bn

Loans to small & medium-sized businesses

Business Term Deposits

Savings made easier, better, just for you.

SMSF Term Deposits

A worry-free way to invest

$

0

bn

Term Deposits Funded

$

0

Term Deposit Customers

Apply Now

Challenger

Relationship Banking

Built to say yes

Challenger

Determined to help SMEs get a fairer go when it comes to banking

Relationship Banking

Banking as it used to be…banking as it should be.

Built to say yes

Purpose-built to make it easier for SMEs to get the funding they need when they need it.

$

0

m

Largest capital raise in Australian history

$

0

bn

Loans to small & medium-sized businesses

Business Lending

How do I deposit money into my account?

To fund your Judo Bank deposit, you have two options:

How do I deposit money into my account?

To fund your Judo Bank deposit, you have two options:

- Perform a “Pay Anyone” via your bank account to Judo Bank with BSB 703-888 and your Judo Bank Account Number.

- Perform a BPAY to Judo Bank using Biller Code 274753 and your Judo Bank Account Number as the Biller Reference Code. You can transfer up to $250,000 per day via BPAY.