Where To Find The Best

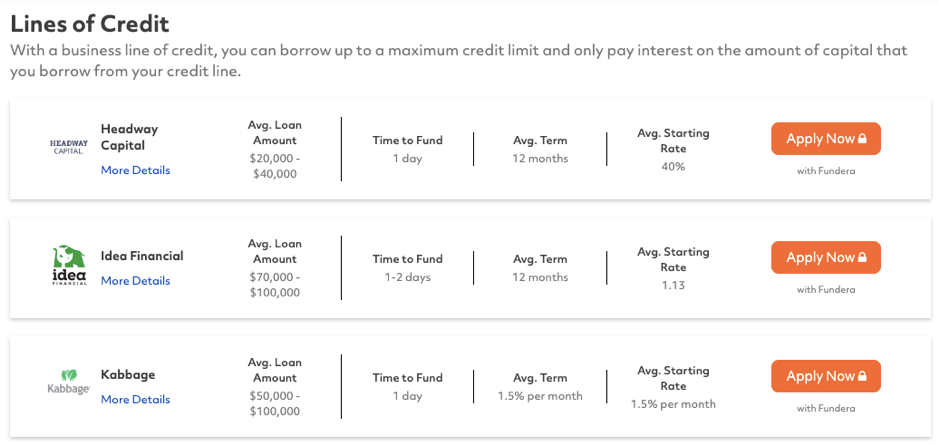

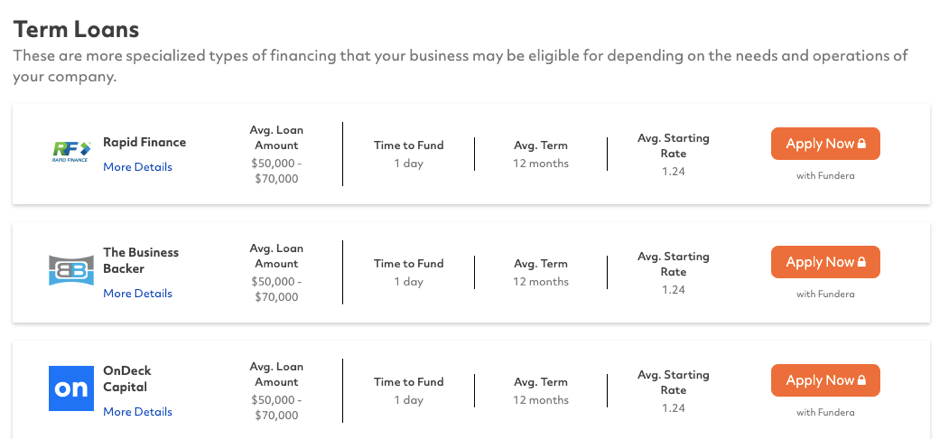

We reviewed the competition and found

Fundera were the best place to find businesses capital when they need it.

We found they had the best selection of business loans that made sure we got a competitive rate that was approved within minutes.

We also loved working with their expert customer service team (shout out to Pam!). They were friendly, & honest. They understood the fine print and answered all our (sometimes silly) questions.

Before we locked in our next round of business financing we would be checking a wide range of lenders with Fundera before signing.

Compare Business Loans

Compare Business Loans

How

Works?

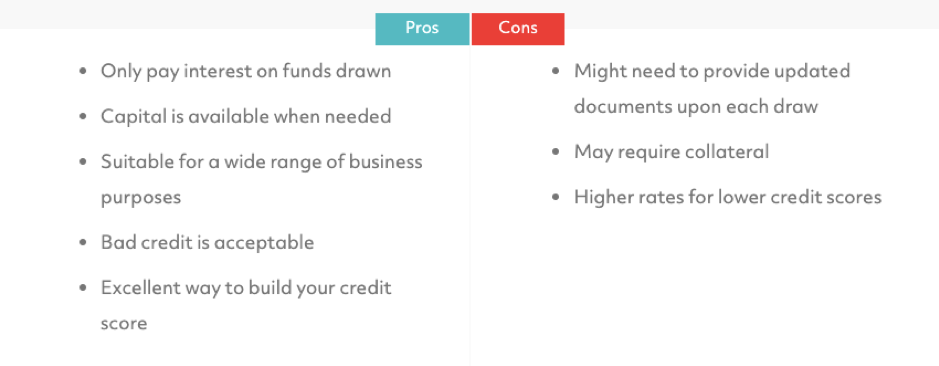

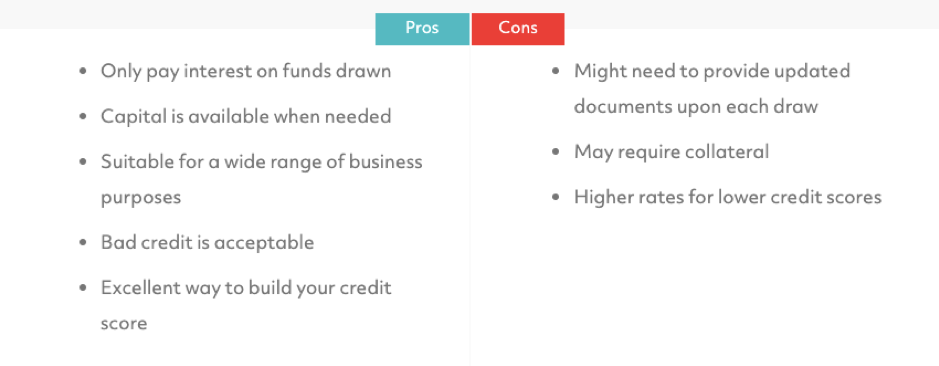

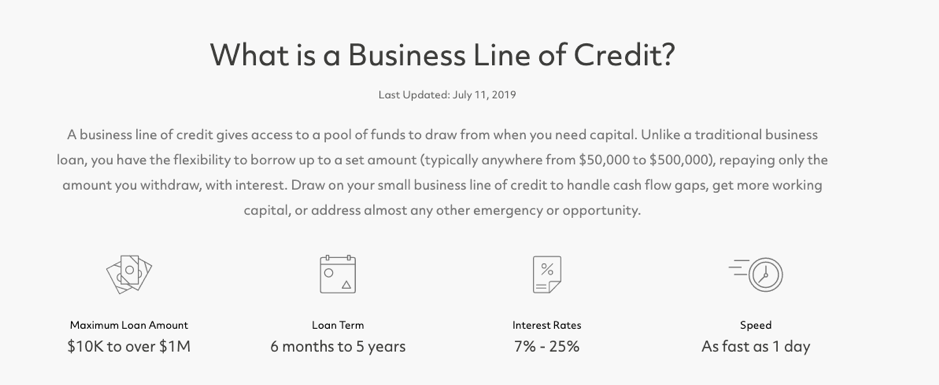

Funds available on demand

Only pay for what you use

Access to a revolving line

Financing that grows with you

Funds available on demand

Enjoy peace of mind by having money available for any business expense. Draw funds with a click of a button.

Only pay for what you use

No fees to open or maintain your line. No prepayment fees, monthly maintenance fees, or account closure fees.

Access to a revolving line

Draw as little or as much as you want from your available credit. Your credit line replenishes as you make repayments.`

Financing that grows with you

We support your business growth by getting you the right credit line for your business size at any stage.

Apply Online

Draw funds

Make repayments

Access more funds

Apply Online

Draw funds

Make repayments

Access more funds

Apply Online

Provide them basic information about your business and get approved in as fast as 5 minutes.

Draw funds

Use your online dashboard to request funds, and get cash in your bank account within hours.

3

Make repayments

Pay back each draw with fixed monthly or weekly payments over 6 or 12 months.

Access more funds

As you pay off your balance, your available credit is automatically replenished.

What You

To Get Started

Minimum qualifications

What you need to apply

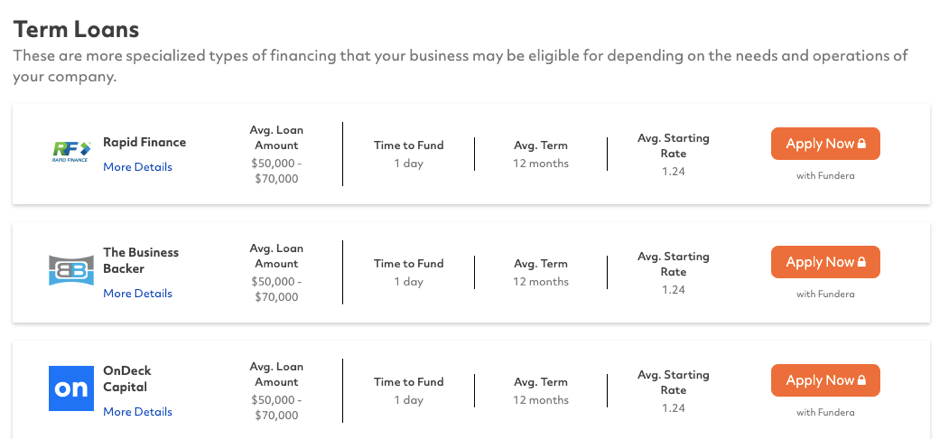

Designed for Growth

Designed for Growth

Get 100% of the funds upfront to invest in projects that help grow your business.

Transparent Pricing

Their pricing is simple. Pay a fixed, weekly rate over 6 or 12 months, with no origination fee.

Fast Funding

Apply online in minutes and have funds deposited in your bank account in as fast as a few hours.

3

Dedicated Advisors

Their advisors are available to walk you through the process and help you obtain the funds you need.

How

Works?

Apply Online

Apply Online

Apply with basic information about you and your business. Your credit score won’t be impacted.

Get approved

Get a decision on your application in as fast as 5 minutes.

Get funds

Once approved, get cash in your bank account in as fast as a few hours.

3

Make repayments

Payments are auto-debited from your bank account each week. No need to worry about missing payments.

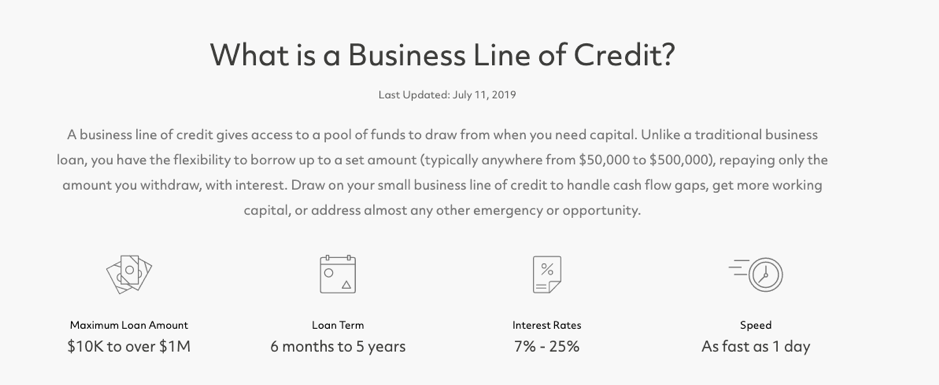

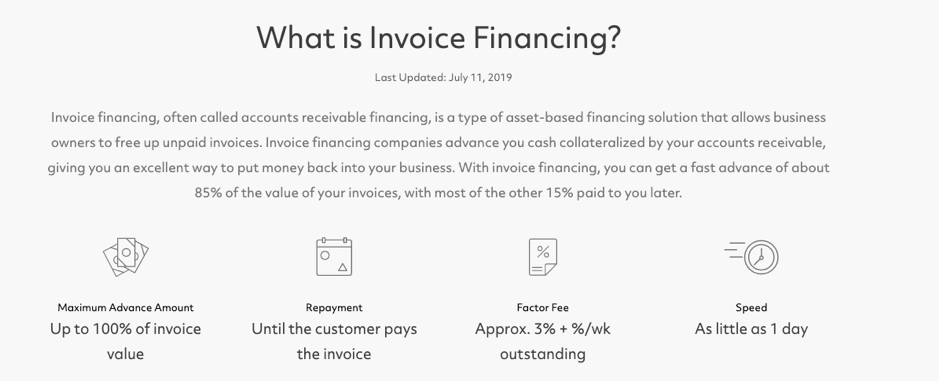

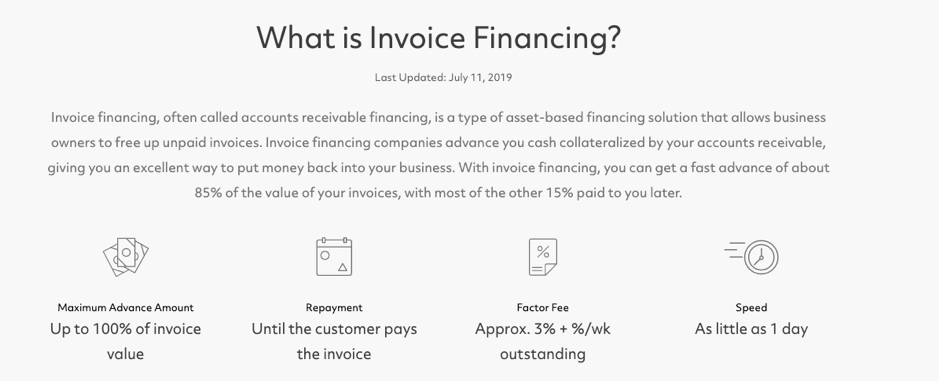

What is

Get larger credit limits

Get larger credit limits

Get a credit line based on the strength of your customers. As your sales grow, so can your credit limit.

Free up your cash

Unlike a traditional loan, there are no recurring payments when your customer pays by the invoice due date.

Fund only what you want

You decide how many and which invoices to submit. Fund only what you need, when you need, without long-term contracts.

Transparent fees

Know exactly what you’re paying with our straightforward fees. We charge a simple weekly fee due when the invoice is paid.

We got what we needed, quickly & simply, to get the job done

Gaston & MoniqueHickies

Gaston & MoniqueHickies

It’s amazing what a painless experience it was

Pam BeachCapital Dove Cleaning

Pam BeachCapital Dove Cleaning

“But we wouldn’t be able to do it without Fundera”

Marcus WilsonNobull

Marcus WilsonNobull

Previous

Next

Fundera provide you expert choice a& advice to make the right decisions when it matters most. Don’t get ripped off, compare the market on Fundera before making a choice. We did. And we didn’t regret it.

Apply Now

Featured,

Fintech,

Legaltech

/

February 19, 2020

/

Lynne Becera

Compare Business Loans

Compare Business Loans

Apply Online

Draw funds

Make repayments

Access more funds

Apply Online

Provide them basic information about your business and get approved in as fast as 5 minutes.

Draw funds

Use your online dashboard to request funds, and get cash in your bank account within hours.3

Make repayments

Pay back each draw with fixed monthly or weekly payments over 6 or 12 months.

Access more funds

As you pay off your balance, your available credit is automatically replenished.

Apply Online

Draw funds

Make repayments

Access more funds

Apply Online

Provide them basic information about your business and get approved in as fast as 5 minutes.

Draw funds

Use your online dashboard to request funds, and get cash in your bank account within hours.3

Make repayments

Pay back each draw with fixed monthly or weekly payments over 6 or 12 months.

Access more funds

As you pay off your balance, your available credit is automatically replenished.

Designed for Growth

Get 100% of the funds upfront to invest in projects that help grow your business.

Transparent Pricing

Their pricing is simple. Pay a fixed, weekly rate over 6 or 12 months, with no origination fee.

Fast Funding

Apply online in minutes and have funds deposited in your bank account in as fast as a few hours.3

Dedicated Advisors

Their advisors are available to walk you through the process and help you obtain the funds you need.

Designed for Growth

Get 100% of the funds upfront to invest in projects that help grow your business.

Transparent Pricing

Their pricing is simple. Pay a fixed, weekly rate over 6 or 12 months, with no origination fee.

Fast Funding

Apply online in minutes and have funds deposited in your bank account in as fast as a few hours.3

Dedicated Advisors

Their advisors are available to walk you through the process and help you obtain the funds you need.

Apply Online

Apply with basic information about you and your business. Your credit score won’t be impacted.

Get approved

Get a decision on your application in as fast as 5 minutes.

Get funds

Once approved, get cash in your bank account in as fast as a few hours.3

Make repayments

Payments are auto-debited from your bank account each week. No need to worry about missing payments.

Apply Online

Apply with basic information about you and your business. Your credit score won’t be impacted.

Get approved

Get a decision on your application in as fast as 5 minutes.

Get funds

Once approved, get cash in your bank account in as fast as a few hours.3

Make repayments

Payments are auto-debited from your bank account each week. No need to worry about missing payments.

Get larger credit limits

Get a credit line based on the strength of your customers. As your sales grow, so can your credit limit.

Free up your cash

Unlike a traditional loan, there are no recurring payments when your customer pays by the invoice due date.

Fund only what you want

You decide how many and which invoices to submit. Fund only what you need, when you need, without long-term contracts.

Transparent fees

Know exactly what you’re paying with our straightforward fees. We charge a simple weekly fee due when the invoice is paid.

We got what we needed, quickly & simply, to get the job done

Get larger credit limits

Get a credit line based on the strength of your customers. As your sales grow, so can your credit limit.

Free up your cash

Unlike a traditional loan, there are no recurring payments when your customer pays by the invoice due date.

Fund only what you want

You decide how many and which invoices to submit. Fund only what you need, when you need, without long-term contracts.

Transparent fees

Know exactly what you’re paying with our straightforward fees. We charge a simple weekly fee due when the invoice is paid.

We got what we needed, quickly & simply, to get the job done

Gaston & MoniqueHickies

It’s amazing what a painless experience it was

Gaston & MoniqueHickies

It’s amazing what a painless experience it was

Pam BeachCapital Dove Cleaning

“But we wouldn’t be able to do it without Fundera”

Pam BeachCapital Dove Cleaning

“But we wouldn’t be able to do it without Fundera”

Marcus WilsonNobull

Previous

Next

Marcus WilsonNobull

Previous

Next

Fundera provide you expert choice a& advice to make the right decisions when it matters most. Don’t get ripped off, compare the market on Fundera before making a choice. We did. And we didn’t regret it.

Apply Now

Featured,Fintech,Legaltech

/

February 19, 2020

/

Lynne Becera

Fundera provide you expert choice a& advice to make the right decisions when it matters most. Don’t get ripped off, compare the market on Fundera before making a choice. We did. And we didn’t regret it.

Apply Now

Featured,Fintech,Legaltech

/

February 19, 2020

/

Lynne Becera