Leader in

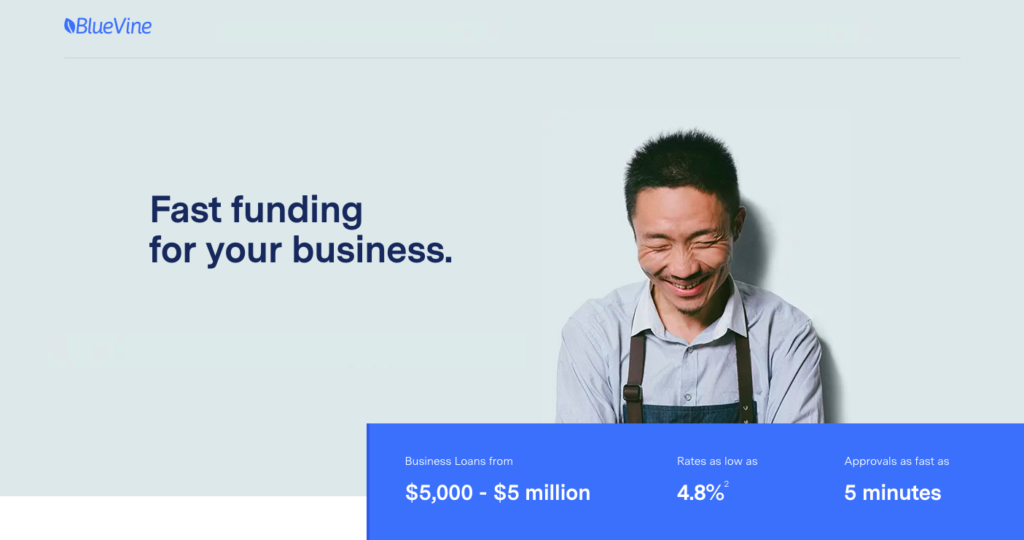

We reviewed the competition and found Blue Vine were the best lender to provide small businesses like access to capital when they need it. By combining the latest advancements in technology and security with the expertise and care of Blue Vine’s team, we found they able to serve business owners across the US in an efficient, simply, and honest manner. Just the way getting business financing should be.

Our confidence in BlueVine is constructed around the fact they service thousands of small business owners already, and help them every day with the funds they need to achieve their business goals. Simple & quick financing, snap!

Visit BlueVine

Visit BlueVine

The

BlueVine | Our Top Pick

Why Blue Vine:

- Competitive Rates

- Approved Within Minutes

- 5 Star Customer Service

PRODUCTS;

- Line of Credit

- Invoice Factoring

- Term Loans

BlueVine was our Top Pick because they provided great rates, amazingly fast approval times (minutes!) and stellar customers service (phone & email, always available!). It was the customer service we liked the most. Getting someone to help with selecting the right product and an honest, straight shooting opinion as well. We never felt like we weree being sold to. Their business focuses on helping SME business owners with the working capital they need to run and grow their business. They gave us quick access to funds that allow our business to grow. Period.

Background: Founded in 2013, BlueVine’s mission is to empower small businesses with innovative banking designed for them. BlueVine offers a suite of products designed to meet the diverse financial needs of today’s business owners including BlueVine Business Checking Account, Line of Credit, Term Loan, and Invoice Factoring. Headquartered in Redwood City, California, BlueVine has provided small and medium-sized businesses with access to more than $2.5 billion in financing and is backed by leading private and institutional investors. All lines of credit and term loan products are issued by Celtic Bank, a Utah-chartered Industrial Bank, Member FDIC. All banking services are provided by The Bancorp Bank, Member FDIC.

Loanbuilder

LoanBuilder is a subsidiary of PayPal that merged with Swift Capital and a few other alternative lenders to provide business owners with a unique alternative lending experience. Business owners can prequalify and then build their loan with their own terms and rates, depending on the financial stability of the business.

Lendio

Lendio

Lendio offers American Express Merchant Financing, SBA Loans, Term Business Loans, Short Term Loans, Business Lines of Credit, Startup Loans, Equipment Financing…see where I’m going with this? The list goes on and on.

Kabbage

Kabbage

Kabbage, Inc. is an online financial technology company based in Atlanta, Georgia. The company provides funding directly to small businesses and consumers through an automated lending platform.

Fundera

Fundera is the go-to financial resource for every small business—helping you face your challenges, achieve your financial goals, and grow businesses as big as your aspirations.

Biz2credit

Biz2Credit is an online credit resource offering finance to small businesses. The company provides direct funding to small businesses that have been in business for at least six months.

How

Works?

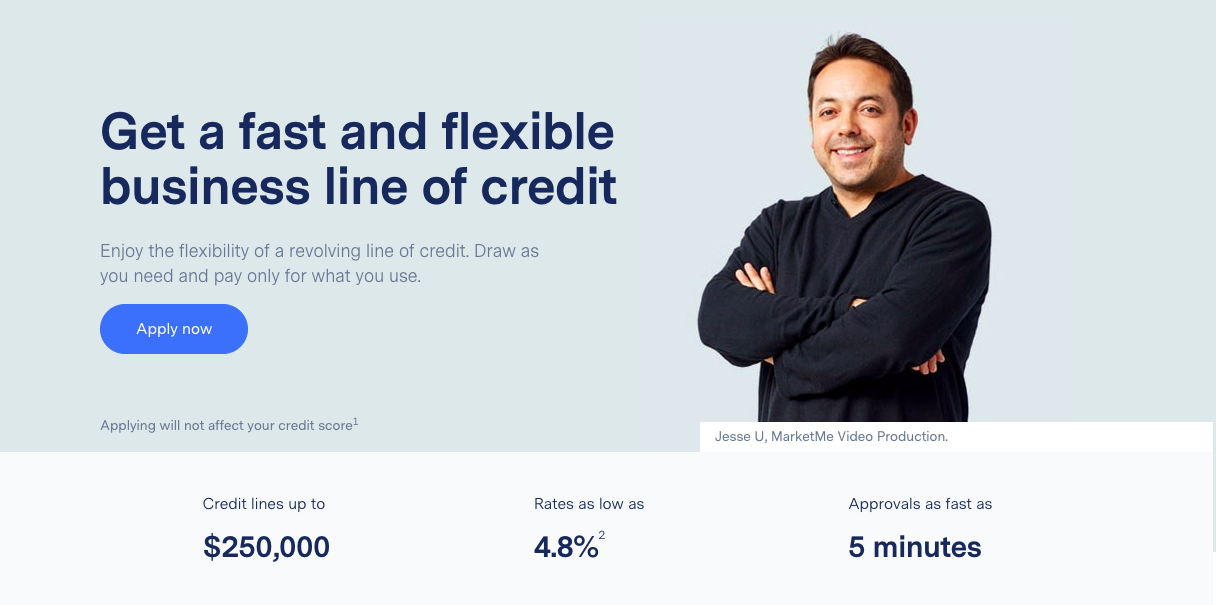

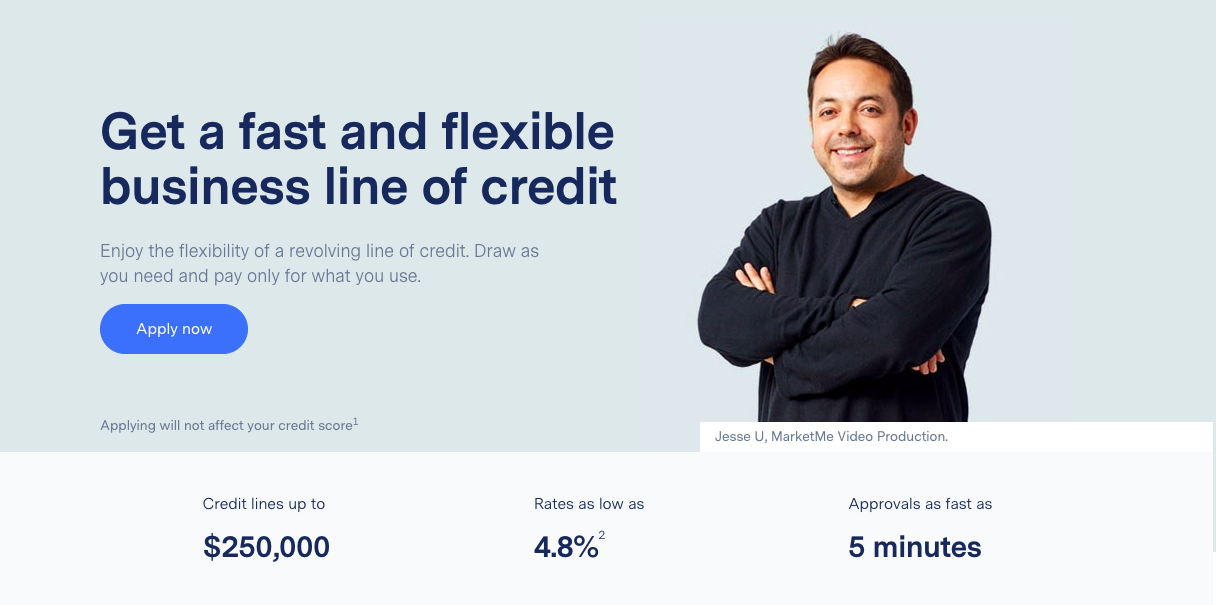

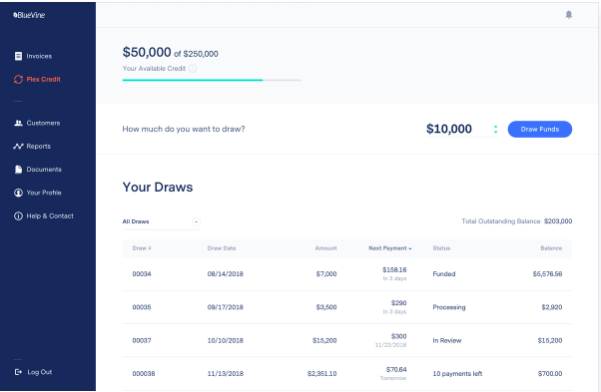

Funds available on demand

Only pay for what you use

Access to a revolving line

Financing that grows with you

Funds available on demand

Enjoy peace of mind by having money available for any business expense. Draw funds with a click of a button.

Only pay for what you use

No fees to open or maintain your line. No prepayment fees, monthly maintenance fees, or account closure fees.

Access to a revolving line

Draw as little or as much as you want from your available credit. Your credit line replenishes as you make repayments.`

Financing that grows with you

We support your business growth by getting you the right credit line for your business size at any stage.

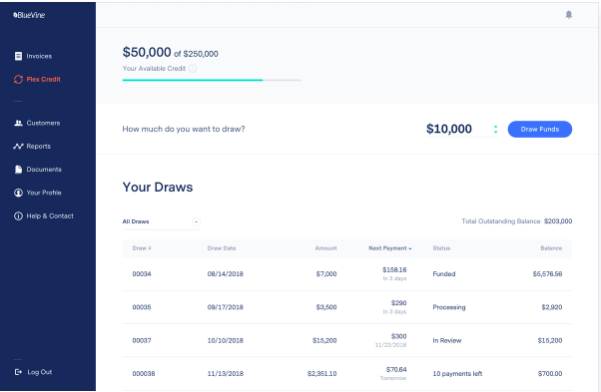

Apply Online

Draw funds

Make repayments

Access more funds

Apply Online

Draw funds

Make repayments

Access more funds

Apply Online

Provide them basic information about your business and get approved in as fast as 5 minutes.

Draw funds

Use your online dashboard to request funds, and get cash in your bank account within hours.

3

Make repayments

Pay back each draw with fixed monthly or weekly payments over 6 or 12 months.

Access more funds

As you pay off your balance, your available credit is automatically replenished.

What You

To Get Started

Minimum qualifications

- 600+ FICO

- 6+ months in business

- $10,000 in monthly revenue

What you need to apply

- Basic details about you and your business

- Bank connection or 3 months most recent bank statements

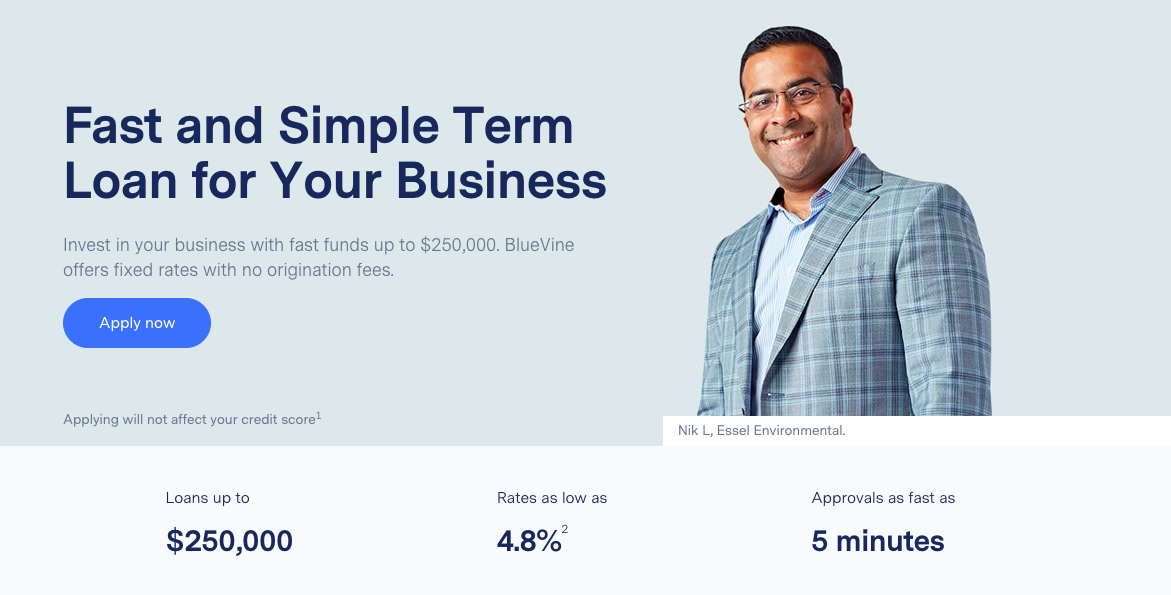

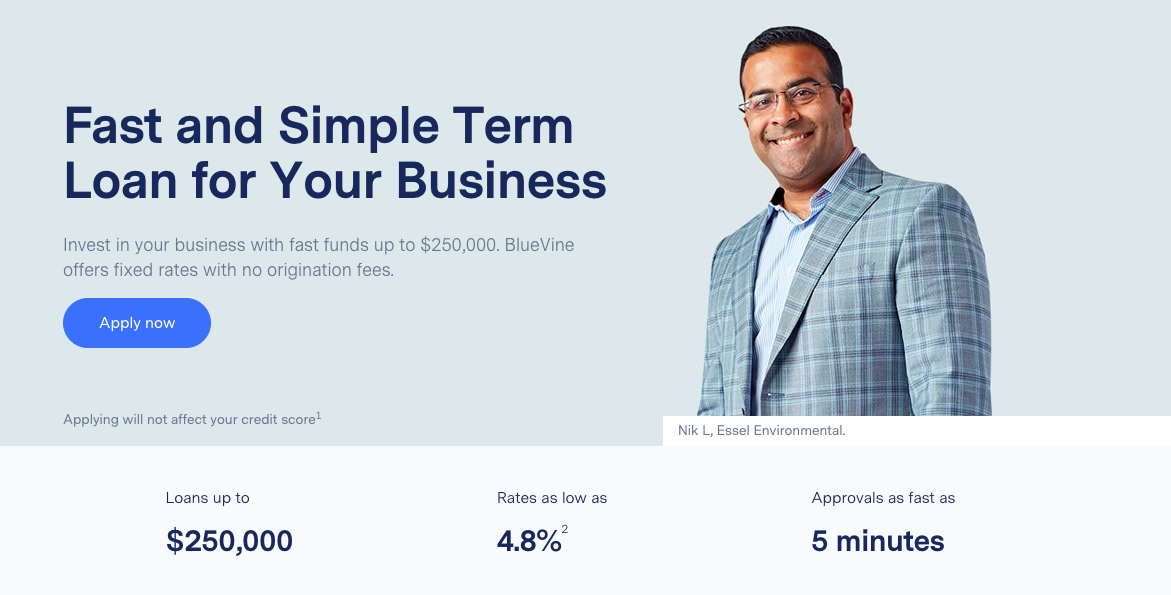

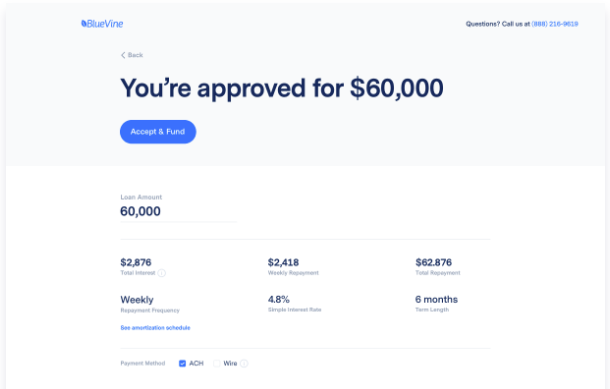

Designed for Growth

Designed for Growth

Get 100% of the funds upfront to invest in projects that help grow your business.

Transparent Pricing

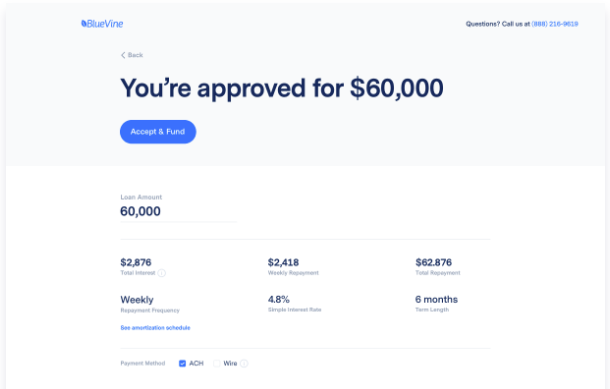

Their pricing is simple. Pay a fixed, weekly rate over 6 or 12 months, with no origination fee.

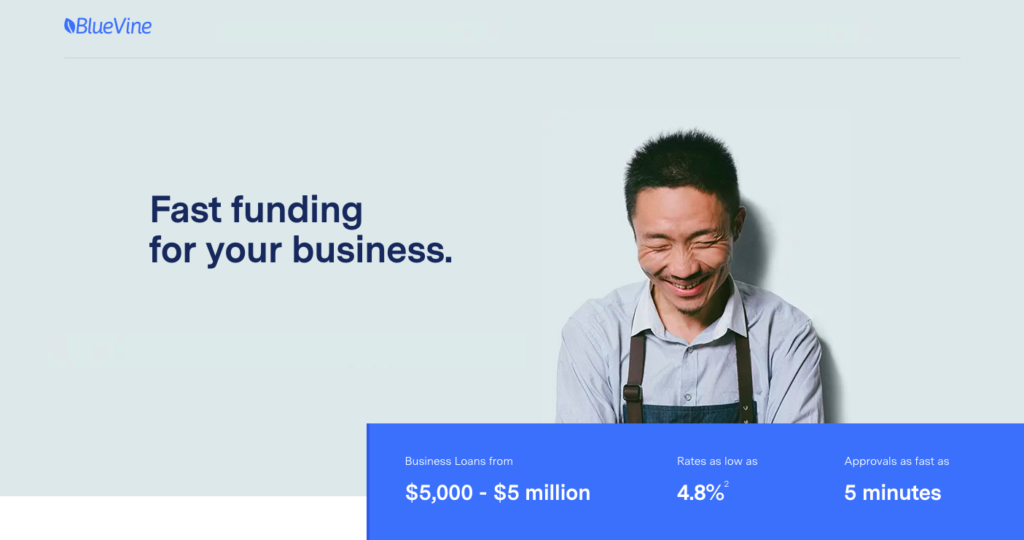

Fast Funding

Apply online in minutes and have funds deposited in your bank account in as fast as a few hours.

3

Dedicated Advisors

Their advisors are available to walk you through the process and help you obtain the funds you need.

How

Works?

Apply Online

Apply Online

Apply with basic information about you and your business. Your credit score won’t be impacted.

Get approved

Get a decision on your application in as fast as 5 minutes.

Get funds

Once approved, get cash in your bank account in as fast as a few hours.

3

Make repayments

Payments are auto-debited from your bank account each week. No need to worry about missing payments.

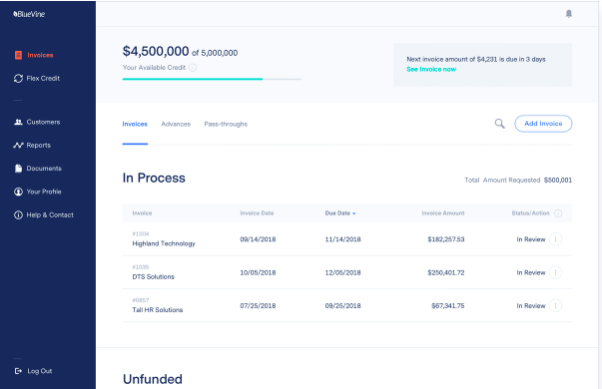

Get larger credit limits

Get larger credit limits

Get a credit line based on the strength of your customers. As your sales grow, so can your credit limit.

Free up your cash

Unlike a traditional loan, there are no recurring payments when your customer pays by the invoice due date.

Fund only what you want

You decide how many and which invoices to submit. Fund only what you need, when you need, without long-term contracts.

Transparent fees

Know exactly what you’re paying with our straightforward fees. We charge a simple weekly fee due when the invoice is paid.

How

Works?

Apply online

Apply online

Apply in less than 10 minutes with basic details about your business and customers.

Get approved

BlueVine will review your application and reach out with a decision in as fast as 24 hours.

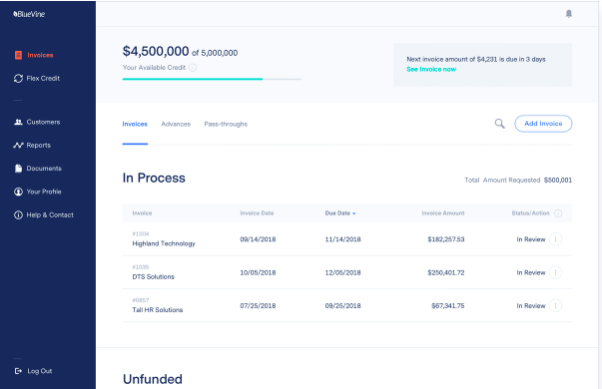

Submit an invoice

Automatically sync invoices from your accounting software or upload invoices to your dashboard.

Get your advance

They provide ~85-90% of the money upfront. You get the rest, minus our fee, once the invoice is paid.

BlueVine gave us the confidence to close the biggest deals in our company’s history – without worrying about capital.

Nik L Essel Environmental

Our product launch was a wild success, but we had to wait an average of 60 days before retailers paid us. In just a few days, BlueVine gave us the cash we needed to cover our expenses.

Sean APlox

BlueVine was super easy to use and lightening fast! As plain as I can put it, it works for your business

Austin SHRS Window Cleaners

Previous

Next

BlueVine is the a leader in providing access to online working capital for small businesses. They offer generous invoice financing terms, allowing businesses to borrow up to $5 million through account receivable factoring.

Apply Now

Featured,

Legaltech

/

February 13, 2020

/

Lynne Becera

Visit BlueVine

Visit BlueVine

Lendio

Lendio offers American Express Merchant Financing, SBA Loans, Term Business Loans, Short Term Loans, Business Lines of Credit, Startup Loans, Equipment Financing…see where I’m going with this? The list goes on and on.

Lendio

Lendio offers American Express Merchant Financing, SBA Loans, Term Business Loans, Short Term Loans, Business Lines of Credit, Startup Loans, Equipment Financing…see where I’m going with this? The list goes on and on.

Kabbage

Kabbage, Inc. is an online financial technology company based in Atlanta, Georgia. The company provides funding directly to small businesses and consumers through an automated lending platform.

Fundera

Kabbage

Kabbage, Inc. is an online financial technology company based in Atlanta, Georgia. The company provides funding directly to small businesses and consumers through an automated lending platform.

Fundera

Apply Online

Draw funds

Make repayments

Access more funds

Apply Online

Provide them basic information about your business and get approved in as fast as 5 minutes.

Draw funds

Use your online dashboard to request funds, and get cash in your bank account within hours.3

Make repayments

Pay back each draw with fixed monthly or weekly payments over 6 or 12 months.

Access more funds

As you pay off your balance, your available credit is automatically replenished.

Apply Online

Draw funds

Make repayments

Access more funds

Apply Online

Provide them basic information about your business and get approved in as fast as 5 minutes.

Draw funds

Use your online dashboard to request funds, and get cash in your bank account within hours.3

Make repayments

Pay back each draw with fixed monthly or weekly payments over 6 or 12 months.

Access more funds

As you pay off your balance, your available credit is automatically replenished.

Designed for Growth

Get 100% of the funds upfront to invest in projects that help grow your business.

Transparent Pricing

Their pricing is simple. Pay a fixed, weekly rate over 6 or 12 months, with no origination fee.

Fast Funding

Apply online in minutes and have funds deposited in your bank account in as fast as a few hours.3

Dedicated Advisors

Their advisors are available to walk you through the process and help you obtain the funds you need.

Designed for Growth

Get 100% of the funds upfront to invest in projects that help grow your business.

Transparent Pricing

Their pricing is simple. Pay a fixed, weekly rate over 6 or 12 months, with no origination fee.

Fast Funding

Apply online in minutes and have funds deposited in your bank account in as fast as a few hours.3

Dedicated Advisors

Their advisors are available to walk you through the process and help you obtain the funds you need.

Apply Online

Apply with basic information about you and your business. Your credit score won’t be impacted.

Get approved

Get a decision on your application in as fast as 5 minutes.

Get funds

Once approved, get cash in your bank account in as fast as a few hours.3

Make repayments

Payments are auto-debited from your bank account each week. No need to worry about missing payments.

Apply Online

Apply with basic information about you and your business. Your credit score won’t be impacted.

Get approved

Get a decision on your application in as fast as 5 minutes.

Get funds

Once approved, get cash in your bank account in as fast as a few hours.3

Make repayments

Payments are auto-debited from your bank account each week. No need to worry about missing payments.

Get larger credit limits

Get a credit line based on the strength of your customers. As your sales grow, so can your credit limit.

Free up your cash

Unlike a traditional loan, there are no recurring payments when your customer pays by the invoice due date.

Fund only what you want

You decide how many and which invoices to submit. Fund only what you need, when you need, without long-term contracts.

Transparent fees

Know exactly what you’re paying with our straightforward fees. We charge a simple weekly fee due when the invoice is paid.

Get larger credit limits

Get a credit line based on the strength of your customers. As your sales grow, so can your credit limit.

Free up your cash

Unlike a traditional loan, there are no recurring payments when your customer pays by the invoice due date.

Fund only what you want

You decide how many and which invoices to submit. Fund only what you need, when you need, without long-term contracts.

Transparent fees

Know exactly what you’re paying with our straightforward fees. We charge a simple weekly fee due when the invoice is paid.

Apply online

Apply in less than 10 minutes with basic details about your business and customers.

Get approved

BlueVine will review your application and reach out with a decision in as fast as 24 hours.

Submit an invoice

Automatically sync invoices from your accounting software or upload invoices to your dashboard.

Get your advance

They provide ~85-90% of the money upfront. You get the rest, minus our fee, once the invoice is paid.

BlueVine gave us the confidence to close the biggest deals in our company’s history – without worrying about capital.

Nik L Essel Environmental

Our product launch was a wild success, but we had to wait an average of 60 days before retailers paid us. In just a few days, BlueVine gave us the cash we needed to cover our expenses.

Sean APlox

BlueVine was super easy to use and lightening fast! As plain as I can put it, it works for your business

Austin SHRS Window Cleaners

Previous

Next

Apply online

Apply in less than 10 minutes with basic details about your business and customers.

Get approved

BlueVine will review your application and reach out with a decision in as fast as 24 hours.

Submit an invoice

Automatically sync invoices from your accounting software or upload invoices to your dashboard.

Get your advance

They provide ~85-90% of the money upfront. You get the rest, minus our fee, once the invoice is paid.

BlueVine gave us the confidence to close the biggest deals in our company’s history – without worrying about capital.

Nik L Essel Environmental

Our product launch was a wild success, but we had to wait an average of 60 days before retailers paid us. In just a few days, BlueVine gave us the cash we needed to cover our expenses.

Sean APlox

BlueVine was super easy to use and lightening fast! As plain as I can put it, it works for your business

Austin SHRS Window Cleaners

Previous

Next

BlueVine is the a leader in providing access to online working capital for small businesses. They offer generous invoice financing terms, allowing businesses to borrow up to $5 million through account receivable factoring.

Apply Now

Featured,Legaltech

/

February 13, 2020

/

Lynne Becera

BlueVine is the a leader in providing access to online working capital for small businesses. They offer generous invoice financing terms, allowing businesses to borrow up to $5 million through account receivable factoring.

Apply Now

Featured,Legaltech

/

February 13, 2020

/

Lynne Becera